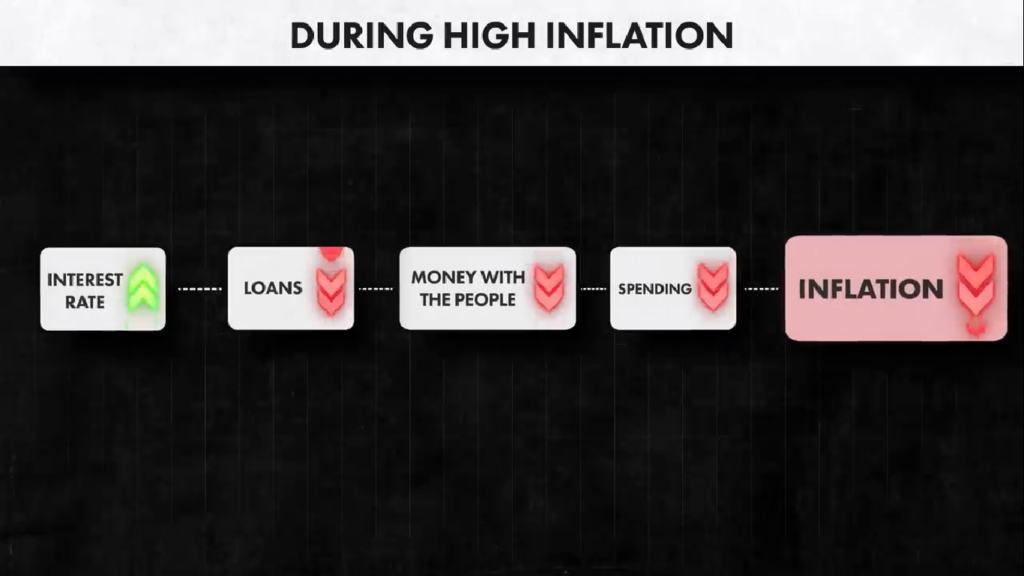

This is why during the pandemic, interest rates were lowered by the government. On the other hand, if inflation is on the rise in an economy, Interest rates are increased to control it. Increasing interest rates would make loans more expensive. Fewer people would want to take loans. People would not have enough money to spend, And the spending would decrease. With lower spending, inflation could be controlled. This is a general and simplified explanation.

Over the last several months, inflation was rapidly increasing in America and Europe Due to several reasons, One of which is the Russia-Ukraine War. To control this inflation, the Federal Reserve increased interest rates. Though this can be considered the root cause, Bad decision-making by the bank was also at play here. Interest rates will continue to fluctuate, You need to have a robust portfolio, So that it can bear these fluctuations.

The next question was what would happen to the funds of the people and companies that were deposited with the bank? There’s a limit to insurance. To a certain limit, the money deposited with the banks is insured that is the law. In America, the limit is $250,000. This might seem like a large limit. But the clients and customers of Silicon Valley Bank, Were startups with a lot of money. It is reported that 89% of the deposits were uninsured.