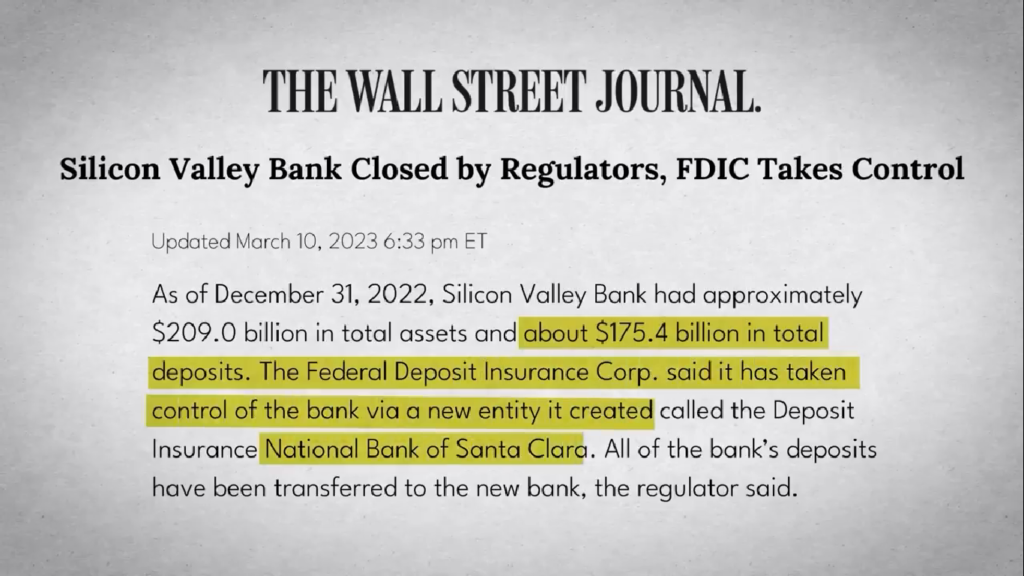

But the response of the American government was similar to the Indian government’s response when Indian banks crashed. The California Department of Financial Protection and Innovation pounced on the Silicon Valley Bank’s office. The receivership of the bank was handed over to the Federal Deposit Insurance Corporation (FDIC). Customer deposits to the tune of $175 billion Was used by FDIC to create a new bank, National Bank of Santa Clara.

The assets of Silicon Valley Bank were taken over So that usual business activities could be continued. And then began the search of a bank willing to merge with Silicon Valley Bank. That’s right. Merger is a solution here. 2.5 years ago, when the PMC bank crashed in India The Indian government did the same thing. The PMC Bank was merged with the Unity Small Finance Bank. To ensure that the deposits of the public could be safeguarded And later could be withdrawn safely.

In the case of Silicon Valley Bank, it is yet to be seen which bank would it merge into. But US President Joe Biden has assured that The deposits made with the bank would be safe. That even the uninsured money would be safe. But a major impact of this bank crash is that In the stock market, the value of US banks has taken a nosedive.