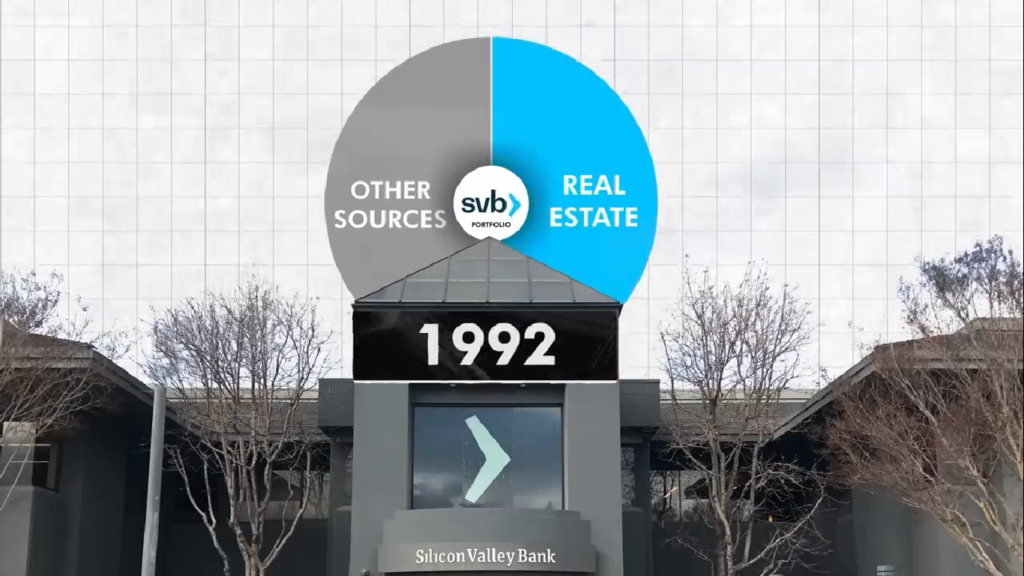

This bank invested a large chunk of its money into real estate. In the early 1990s, half of this bank’s portfolio, Was made up of the real estate property business. All your investments are collectively known as a portfolio. Every person has a portfolio. Any investment into stocks, gold, or even in cash, Makes your portfolio. You would have seen financial experts advise that Every portfolio needs to be ‘diversified’. One shouldn’t invest all the funds into a single asset. It is highly risky.

Suppose you use all your savings for buying gold. Since someone told you buying gold is a good investment option. And then one day, the gold market crashes. What would happen to you? Your savings turned into dust.

Something similar happened to Silicon Valley Bank back then. 50% of their portfolio was real estate investments. And in 1992, California’s real estate market crashed terribly. Due to this, the bank had to incur a loss of $2.2 million. After this, the bank realised that they need to diversify their portfolio, So after 1995, the contribution of the real estate business has remained around 10%.

Why did I tell you this? Because the bank is going through a similar thing. But on a much larger scale. Moving on from 1995 to the 2000s, the bank was known for a new thing. This bank was heavily investing in startups. Especially, technology-based startups.