The technology-based companies that were in the venture stage, The bank would give loans to those companies specially. By 2015, the bank had expanded so much, it was reported that 65% of all startups in America Were served by this bank. The companies in the tech industry, were the biggest customers of Silicon Valley Bank. The name fit the bank very well. The technology-based companies in Silicon Valley, Were banking with the Silicon Valley Bank.

There are several Indian technology-based startups were also among these companies. In this aspect, the Silicon Valley Bank was quite unique. It was working almost exclusively for technology-based startups. But the other banks look for diversified customers to give loans to. Such as SBI in India. All types of entities borrow loans from it. Companies across industry lines use the bank. But this wasn’t the case for Silicon Valley Bank.

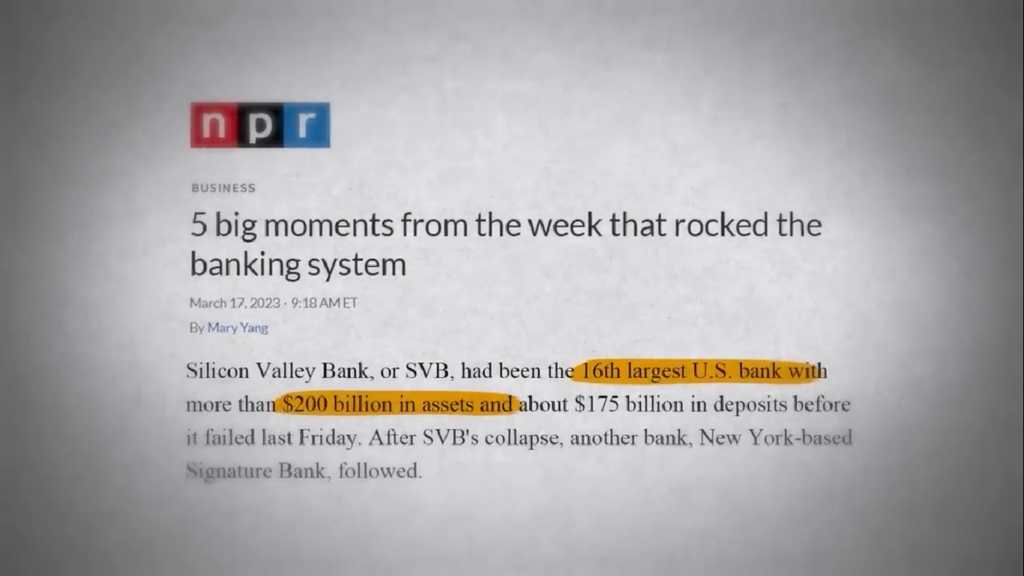

By the end of 2022, Silicon Valley Bank was the 16th biggest lender in America. With the value of its total assets at $209 Billion. ₹17 Trillion! So why did this bank crash? The problems began with the Covid-19 Pandemic.