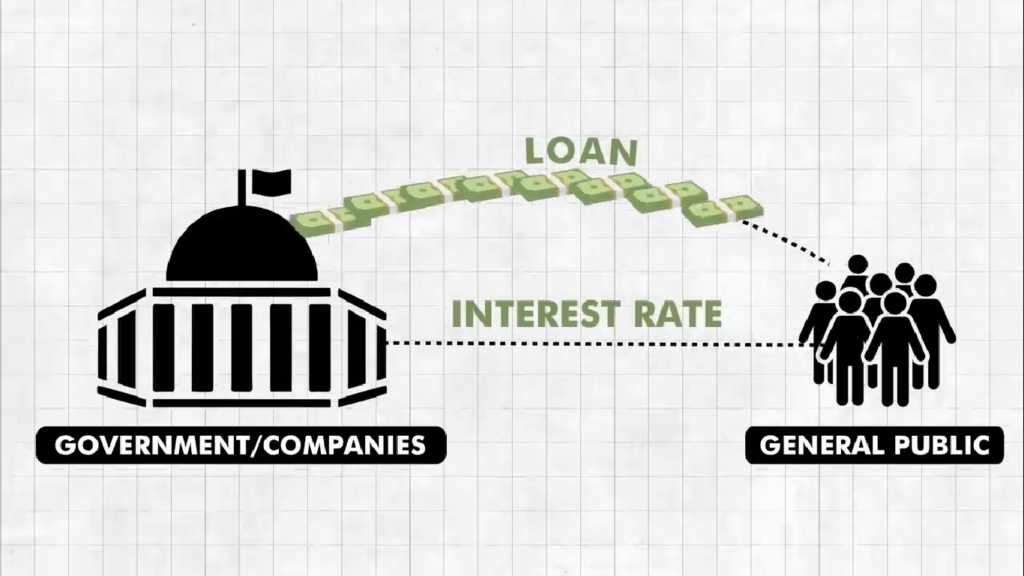

This wasn’t unusual. As we told you earlier, Banks have their business models, They can invest the deposits at various places to make more money. And investing in government bonds is considered relatively very safe. Not only government bonds but corporate bonds were also bought as investments. When large companies or governments are in need of funds They issue bonds. When you buy the bonds and invest your money in it. The money would go to the issuer And would be used by them. But in a way, this money is akin to a loan from you. The issuer promises you interest rates.

And at the end of the period of the bond, suppose 5 years, The issuer would return your money with interest. So investing in bonds is often beneficial for you. Basically, by investing your money, you will receive interest at predetermined rates. This will be your profit. And for the issuer, this is a source of borrowing. They issue bonds due to the immediate need for funds. Silicon Valley Bank bought a large number of bonds at a time when the prevailing interest rates in the market was quite low.

According to America’s Federal Reserve, the interest rates were around 0%-0.25%. Extremely low. It was expected that the interest rates would remain low, But this didn’t happen. The interest rates increased. Without going into too many technicalities, All you need to understand is that bond price and interest rate have an inverse relationship.