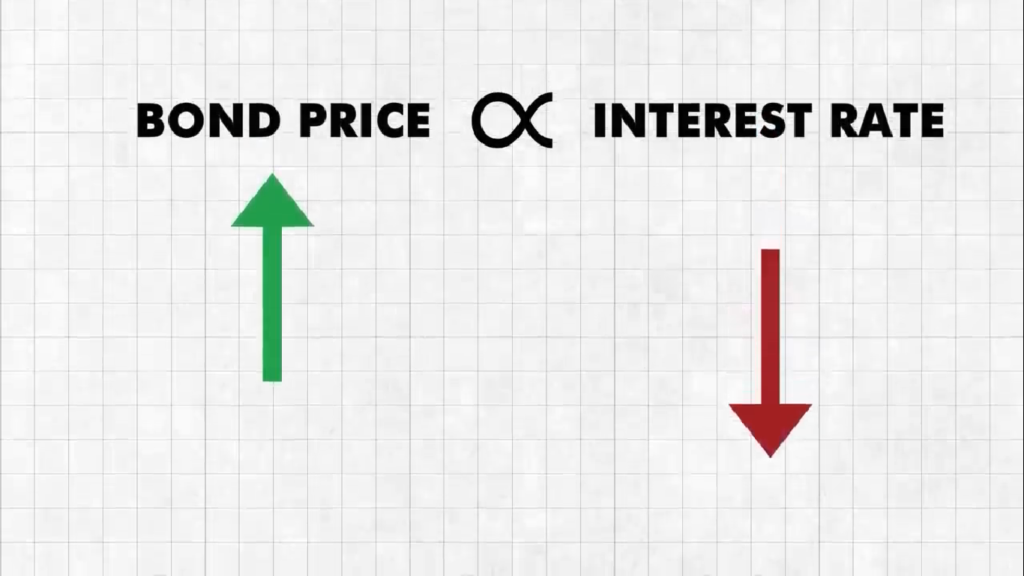

If interest rates go down, bond prices go up. The longer period you hold the bond, the riskier it becomes. The interest rates can fluctuate while you’re holding onto it. The price may fluctuate. It might benefit you or may cause you losses. But if the price of the bond you’ve bought falls, You will have to bear the losses.

This turned into a worst-case scenario for Silicon Valley Bank. The American government increased the interest rates. By raising the interest rates, the value of the bonds held by Silicon Valley Bank crashed. They suffered a huge loss. But this wasn’t the only loss. The second negative impact was even greater. By increasing the interest rates the interest rate on borrowing loans increases as well. For startups and companies, taking loans became more expensive.

So they would avoid taking loans. What else could they do to meet the funding requirements? They would use the money they have deposited into the banks. By 2022, after the interest rates had increased, The tech startups wanted to withdraw their deposits to meet financial needs. Venture capitalists weren’t funding them anymore.