Since they had their deposits with Silicon Valley Bank, they wanted to make withdrawals at the same time, It became problematic for the bank. The money that you deposit with banks, Is not kept safe in a huge vault. Only a small percentage of the deposits are actually stored. And the rest of the money is used for investing and providing loans. It means that if all the customers of any bank want to withdraw money at the same time, The bank would not have enough funds available. Silicon Valley Bank faced the same situation.

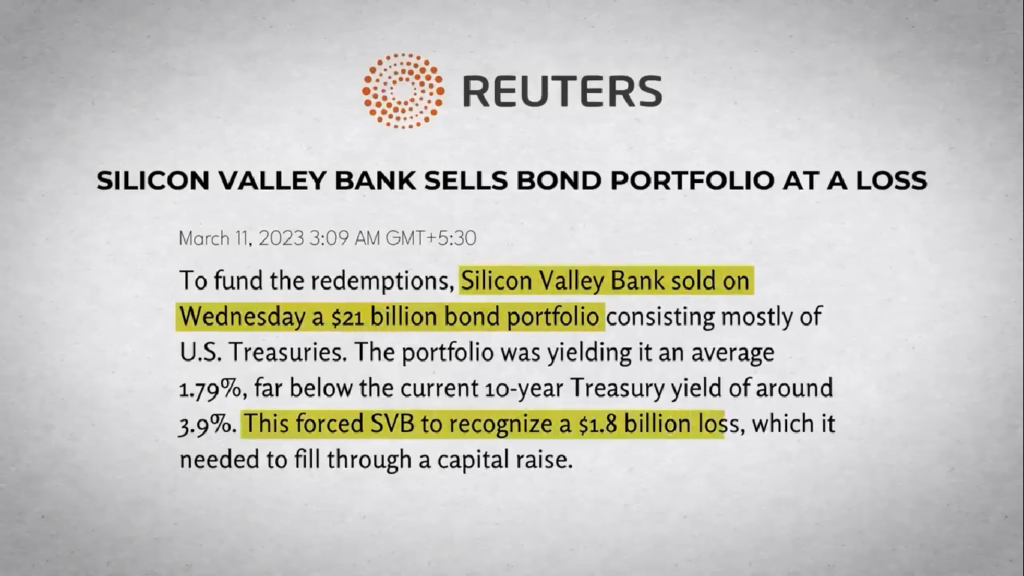

On one hand, the funds they had invested were incurring losses. And on the other hand, their customers want to withdraw their deposits. Due to the demands of the customers, Silicon Valley Bank started selling the bonds. Selling them at a loss. Recently they sold about $21 billion worth of bonds. At a loss of $1.8 billion. Avoiding the downgrade was another reason They sold the bonds at a loss of $1.8 billion.

As soon as the news became public, The value of the shares of Silicon Valley Bank began increasing. As on 9th March 2023, the shares of this bank were down by 60%. The day before, the rating of Silicon Valley Bank was downgraded by Moody’s. At this point in time, no matter what the bank did, it would have been impossible to avoid the crash.

As soon as the news broke that the bank did not have enough funds And that it was selling its investments At billion of dollars in losses, Everyone that had deposited their money with the bank, rushed to withdraw it. They were worried about their money. And everyone rushed together to get their money back. This is known as a Bank Run. But the actual reason why this situation was created Was different in the other 2 cases.