Concept Of Wealth Tax

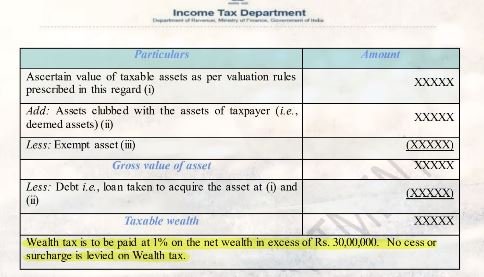

First is the Wealth Tax. It was a tax levied on a person’s entire wealth. If your wealth was more than ₹3 million, then you had to pay tax at 1%. It had a single slab rate of 1%. This tax was introduced in 1957 by the Wealth Tax Act. But on 1st April 2016, the government abolished this tax. Because many people believe having Inheritance tax and Wealth Tax together, would result in double taxation on the same event.

Suppose you own a property worth ₹10 million, then you would have to pay Wealth Tax on it every year. and when you pass on the property to your children, then they would have to pay inheritance tax on it as well. It meant double taxation. But as of now, Wealth Tax has been abolished.