Case Study: USA

Take America for example. There’s the Unified Gift and Estate Tax in America. In America, if a person gives a gift to another, even if it is a family member, has to pay a Gift Tax on it. The exemption limit for it is $15,000 per year. So if the value of the gift is less than $15,000 per year, then it won’t be taxed.

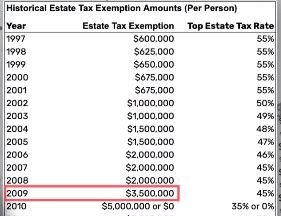

The second, Estate Tax. If someone inherits any property after the death of the owner, then it is subject to tax at the rate of 40%. 40% may seem like a large rate of tax, but the exemption limit to it is very high. Only the richest of the rich have to worry about this tax. Not the average people. During the early 2000s, the rule was that for an estate of less than $1 million, there wouldn’t be any tax on it. In 2009, this threshold was raised to $3.5 million. After that, it was further increased to $5 million.

And in 2017, when Donald Trump became the President, this exemption limit was raised to $11.5 million. It means that only an estate whose value is more than $11.5 million would be subjected to the Estate Tax. And it is only for one individual. For a married couple, this exemption limit is at $23 million. Even rich people may not have to pay this tax. only 0.001% of the super-rich people need to worry about this tax. Due to this, in America in 2019, only 2,570 Taxable Estate Tax Returns were filed. Only about 2,500 people paid this Estate Tax.

But since it is taxed at 40%, and is levied on values about such a high threshold, the government’s revenue from this was at $13.2 billion. The government earned quite a hefty amount. Since Joe Biden became the US President, his party, the Democrats, have proposed that the exemption limit be reduced. That it should be brought back to $5 million. The exemption limit during 2010. It is estimated that if it is done, then the government can earn $52 billion from this tax, in the next 5 years. $13.2 billion sounds like a large number, but in reality, it is approximately 0.5% of the total tax revenue of the government.